DGCX Sees Growth in Gold and Currencies Amidst Increased Geopolitical Risks and Economic Uncertainty

Dubai, July, 02 2017: Dubai Gold and Commodities Exchange (DGCX), the region’s largest and most diversified derivatives bourse, witnessed a surge in Gold and currencies trading in June, which can, in part be attributed to the recent listing of additional ‘Calendar spreads’ on the Exchange’s Gold Futures and G6 Currency contracts.

‘Calendar spreads’ also known as ‘Futures or Intermonth Calendar Spreads’ are a set of futures trading strategies that utilizes future contracts of different expiration months on the same underlying asset. Calendar Spreads are designed for traders to benefit from the difference in movement between near term futures contracts and longer term futures contracts.

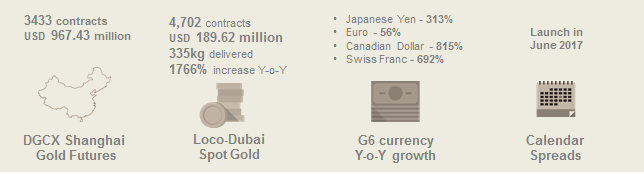

In the first half of the year, DGCX’s Precious Metals segment demonstrated consistently strong performance amidst the rising uncertainty surrounding economic policies and geopolitical risks across the globe. Both Shanghai Gold futures and Spot Gold set record volumes in June, trading their highest monthly volumes and also recorded their highest Average Open Interest (AOI) too. The Loco-Dubai Spot Gold contract achieved its highest monthly volume of 4,702 contracts with a traded value of USD 189.62 million, while it was also a record month for deliveries with over 335kg being exchanged. The contract also saw a significant jump of 1766% over the same period last year, trading a total of 10,172 contracts to-date in 2017. The Yuan-denominated Shanghai Gold Futures traded its highest monthly volume of 3,433 contracts with a value of USD 967.43 million.

G6 currencies continued their upward trajectory in June 2017 vis-à-vis the same period last year with volumes up in Japanese Yen (313%), Euro (56%), Canadian Dollar (815%) and Swiss Franc (692%); aided by the aforementioned Calendar Spreads.

Gaurang Desai, CEO of DGCX, commented on the Exchange’s H1 performance: “DGCX’s robust performance in the first half of the year was influenced by two key factors; Changes being rolled out by President Trump’s policy initiatives, Elections in the UK with the start of Brexit negotiations and other global geopolitical developments, which led investors to use the DGCX to effectively manage their risk. However, the second catalyst for DGCX’s volume growth is a combination of key initiatives rolled out during the first half of the year, including the successful launch of a Chinese gold derivative product, the Exchange’s enhanced risk management framework, the growing number of strategic partnerships (involving local banks and other international exchanges), and the recent listing of additional calendar spreads on DGCX’s key products.

These initiatives have proved valuable adding more depth and confidence to the marketplace. As we move into the second half of the year, we will continue to focus our efforts on tapping similar opportunities that are essential for the further growth of DGCX as well as developing innovative products that are pertinent to our market participants.”

ENDS

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy, equities and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 90 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Meng Chan Shu

Director of Business Development and Sales

Dubai Gold and Commodities Exchange

Tel: +971 4 361 1660

Email: meng.shu@dgcx.ae

or

Dhanya Issac/Lara Batato

Weber Shandwick PRs

Tel: +971 4 445 4222

Email: lbatato@webershandwick.com or lbatato@webershandwick.com